By Dave Ellis

March 18, 2013

Two news items of interest appeared on March 4. First, the announcement by Arizona Mining Inc (Wildcat Silver), “Wildcat Silver to Acquire Riva Gold”. Second, a new report by business and financial advisers Grant Thornton UK LLP that has found that “Junior Mining Companies [like Arizona Mining Inc / Wildcat Silver] are facing significant shortfalls in working capital, posing a major concern to future growth prospects.” Read full article: Money worries weigh on juniors at PDAC

With a little internet research, it is clear that the two items are closely related. First, the Arizona Mining Inc / Wildcat Silver announcement has lots of qualifiers. So, the reality is that Arizona Mining Inc / WS and Riva Gold have simply entered into a Letter of Agreement providing for the acquisition by Arizona Mining Inc / Wildcat Silver of all Riva shares at 4.7 Riva for 1 Arizona Mining Inc / WS share. Riva has C$8.1 million cash and no mineral properties or activities. So it ain’t a done deal. “The proposed acquisition remains subject to, among other things, “– the negotiation and execution of a definitive agreement and applicable shareholder and regulatory approvals.”

Further, Riva agreed to provide a C$1 million loan to Arizona Mining Inc / WS at prime + 4% maturing on 12/31/2013. So WS gets some cash to drill some more holes on or around the Hermosa property. Between the lines, this means Arizona Mining Inc / Wildcat Silver has not been able to attract investor interest and, in desperation, has to accept limited, expensive financing for further exploratory drilling.

Second, Arizona Mining Inc / WS is not alone in failing to attract precious metals investors (suckers?) There are about 1600 Junior mining companies around the world. Neither Arizona Mining Inc / WS nor Riva are even listed as Juniors! The Grant Thornton report states that “Low cash balances, coupled with broader pressures around regulatory risks and rising operating costs, have put some Junior miners at a disadvantage in the capital markets and undoubtedly some of the poorly managed entities will go bust in the near future.” (We can only hope!)

The Back Story

It is helpful to step back and look at the money game in relationship to Gold & Silver. From Wikipedia, we learn that the silver market was 490 million oz (Moz) industrial, 167 Moz jewelry, and 101 Moz investment in 2010. Industrial use transitioned gradually from pre-digital camera photography to RoHS lead-free electronic solder and Photovoltaic solar panels over a 10 year period. The jewelry market is even more stable. Thus, the “real” uses of silver metal evolve slowly. In contrast, the market for silver & gold investment changes as fast as money moves around. Like — Fast! As with the housing market from 2002 to 2008, the precious metals market is currently experiencing an investment bubble.

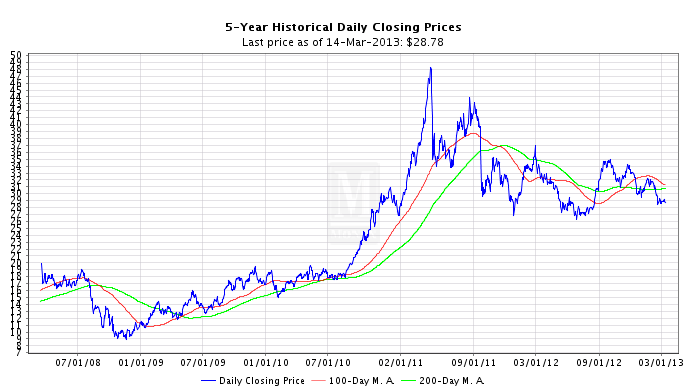

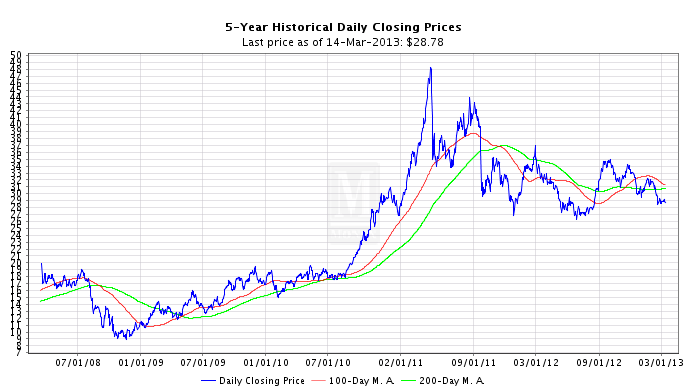

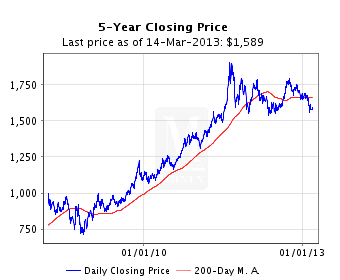

The graphs clearly show both the Gold and Silver “bubbles” now in their terminal downward phase.

Silver Prices

Gold Prices

Check out: http://www.google.com/finance?q=TSE%3AWS&ei=TF5DUZnFENL0rAGheQ

You will see that the price of WS stock mirrors http://www.monex.com/prods/silver_chart.html

PARA’s activism forces Arizona Mining Inc / WS to spend precious $ to move forward. So our efforts make a difference!

Notes: Silver ($45/$10 = 4.5) more volatile than Gold ($1800/$750 = 2.4). Both fast investment bubbles are due to “flight-to-safety in uncertain times”. Euro economies are stabilizing. Therefore, waning gold-silver investment goes down, so junior silver miners are struggling – duuuh!