Press Release

|

|

|

|

|

|

By Dave Ellis

March 18, 2013

Two news items of interest appeared on March 4. First, the announcement by Arizona Mining Inc (Wildcat Silver), “Wildcat Silver to Acquire Riva Gold”. Second, a new report by business and financial advisers Grant Thornton UK LLP that has found that “Junior Mining Companies [like Arizona Mining Inc / Wildcat Silver] are facing significant shortfalls in working capital, posing a major concern to future growth prospects.” Read full article: Money worries weigh on juniors at PDAC

With a little internet research, it is clear that the two items are closely related. First, the Arizona Mining Inc / Wildcat Silver announcement has lots of qualifiers. So, the reality is that Arizona Mining Inc / WS and Riva Gold have simply entered into a Letter of Agreement providing for the acquisition by Arizona Mining Inc / Wildcat Silver of all Riva shares at 4.7 Riva for 1 Arizona Mining Inc / WS share. Riva has C$8.1 million cash and no mineral properties or activities. So it ain’t a done deal. “The proposed acquisition remains subject to, among other things, “– the negotiation and execution of a definitive agreement and applicable shareholder and regulatory approvals.”

Further, Riva agreed to provide a C$1 million loan to Arizona Mining Inc / WS at prime + 4% maturing on 12/31/2013. So WS gets some cash to drill some more holes on or around the Hermosa property. Between the lines, this means Arizona Mining Inc / Wildcat Silver has not been able to attract investor interest and, in desperation, has to accept limited, expensive financing for further exploratory drilling.

Second, Arizona Mining Inc / WS is not alone in failing to attract precious metals investors (suckers?) There are about 1600 Junior mining companies around the world. Neither Arizona Mining Inc / WS nor Riva are even listed as Juniors! The Grant Thornton report states that “Low cash balances, coupled with broader pressures around regulatory risks and rising operating costs, have put some Junior miners at a disadvantage in the capital markets and undoubtedly some of the poorly managed entities will go bust in the near future.” (We can only hope!)

The Back Story

It is helpful to step back and look at the money game in relationship to Gold & Silver. From Wikipedia, we learn that the silver market was 490 million oz (Moz) industrial, 167 Moz jewelry, and 101 Moz investment in 2010. Industrial use transitioned gradually from pre-digital camera photography to RoHS lead-free electronic solder and Photovoltaic solar panels over a 10 year period. The jewelry market is even more stable. Thus, the “real” uses of silver metal evolve slowly. In contrast, the market for silver & gold investment changes as fast as money moves around. Like — Fast! As with the housing market from 2002 to 2008, the precious metals market is currently experiencing an investment bubble.

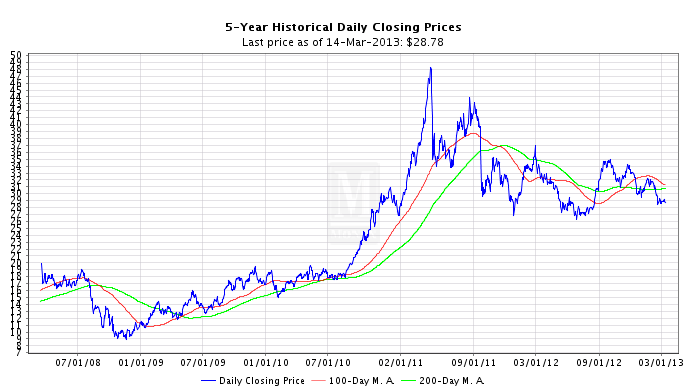

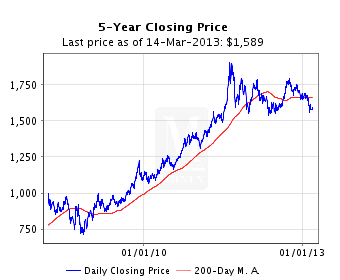

The graphs clearly show both the Gold and Silver “bubbles” now in their terminal downward phase.

Silver Prices

Gold Prices

Check out: http://www.google.com/finance?q=TSE%3AWS&ei=TF5DUZnFENL0rAGheQ

You will see that the price of WS stock mirrors http://www.monex.com/prods/silver_chart.html

PARA’s activism forces Arizona Mining Inc / WS to spend precious $ to move forward. So our efforts make a difference!

Notes: Silver ($45/$10 = 4.5) more volatile than Gold ($1800/$750 = 2.4). Both fast investment bubbles are due to “flight-to-safety in uncertain times”. Euro economies are stabilizing. Therefore, waning gold-silver investment goes down, so junior silver miners are struggling – duuuh!

With the Summer Rain season in full swing, it’s easy to forget that we live in the desert. It’s also easy to forget that we are in a long-term drought. There have been two recent stories in the news about our strained water resources. Both stories discuss water flow in nearby Cienega Creek. KVOA offers NASA images capture Tucson – then and now. The Arizona Daily Star has an article called Cienega Creek, other S. AZ. streams, increasingly dry.

With the Summer Rain season in full swing, it’s easy to forget that we live in the desert. It’s also easy to forget that we are in a long-term drought. There have been two recent stories in the news about our strained water resources. Both stories discuss water flow in nearby Cienega Creek. KVOA offers NASA images capture Tucson – then and now. The Arizona Daily Star has an article called Cienega Creek, other S. AZ. streams, increasingly dry.

The drought raises questions. The biggest one is how in the world can we support mining in the Santa Rita and Patagonia Mountains given the huge amounts of water they consume? Rosemont’s supposed solution is using CAP water to recharge the aquifer. Whether it can be done and whether it will help is debatable. Regardless, Rosemont Copper can pump all the groundwater they want without the CAP recharge.

There are four other mining companies doing mineral explorations in the Patagonia Mountains. Arizona Mining Inc (Wildcat Silver), the one furthest along, estimated that their planned open pit mine would consume roughly 700,000 gallons of water per day. Per day! For comparison, the maximum pumping capacity of the Town of Patagonia’s well water is 110,000 gallons per day. Don’t forget the 3 other international mining companies that want to mine in the Patagonia Mountains. Using the figure of 700,000 gallons of water per day per mine results in 2.8 million gallons of water used per day. Big numbers need perspective.

Because all water sites seem to deal in acre feet, let’s do comparisons in those figures. 2.8 million gallons equals 8.6 acre feet. Estimated water usage from four mines per year using Arizona Mining Inc’s (Wildcat Silver) numbers comes out to 3,139 acre feet. The Santa Cruz Active Management Municipal Areas which includes Nogales, Rio Rico, Tubac, Arivaca, uses 7800 acre feet of water per year. That does not include Patagonia, Sonoita or Elgin. Mining in the Patagonia Mountains could potentially use almost half of all the water used annually in the most populated cities in Santa Cruz County.

Do we even have that much water? Is this drought the new normal?

Sources:

An Investigation of Energy Use, Water Supply and Wastewater Treatment at Patagonia, Arizona

One of those stories that caught our attention was the sudden and immediate departure of Arizona Mining Inc / Wildcat Silver (TSX:AZ) President and CEO Christopher M Jones, announced in a Arizona Mining Inc / Wildcat Silver press release dated May 7, 2012. Board members Richard Warke will assume CEO duties and Donald Taylor, will become President and Chief Operating Officer as well as continuing in their current duties.

You might remember Warke from other news. He is also on the Board of Directors for Augusta Resource (TSX/NYSE:AZC), the company that owns Rosemont Copper. He’s one of 2 men that Save the Scenic Santa Ritas called for investigations by U.S. and Canadian securities regulators, the Arizona Corporation Commission, and the Arizona Attorney General for failure to disclose past bankruptcy.

By the way, Augusta and Arizona Mining Inc / Wildcat Silver are closely related. In addition to Warke, they share 4 other Board members. They also list the same corporate office address, #400 – 837 Hastings St. Vancouver, BC.

It seems extremely odd that if all is going well, why the sudden departure of Chris Jones, President and CEO of Arizona Mining Inc / Wildcat Silver without a new replacement. Another interesting coincidence is that Augusta/Rosemont Copper also had a change at the top just two days later. Augusta announced the retirement of Raghunath Reddy as CFO in a press release dated May 9, 2012.

Two top level executives leaving the Augusta/Wildcat family within two days of each other seems peculiar to us. What about to you? We suppose that the reaction of the investors to this news will tell us more.